With equity markets in a turmoil since 2022 and investors concerned about future earnings potential, Fixed Income has been been a lifeline that investors are holding on to. Investors can now get a 5%+ risk free return. More details in my previous post here.

The Yield to Maturity on Junk bond ETF (Ticker: HYG) is now 8.31%. The effective duration for the ETF is 3.87 years. Comparative duration Treasury bonds (T-Bonds) for the same duration are yielding 4.534%. The question that I have been contemplating is if the spread (extra return over T-Bonds) of 3.8% (8.31% - 3.87%) worth the risk?

More on T-Bonds

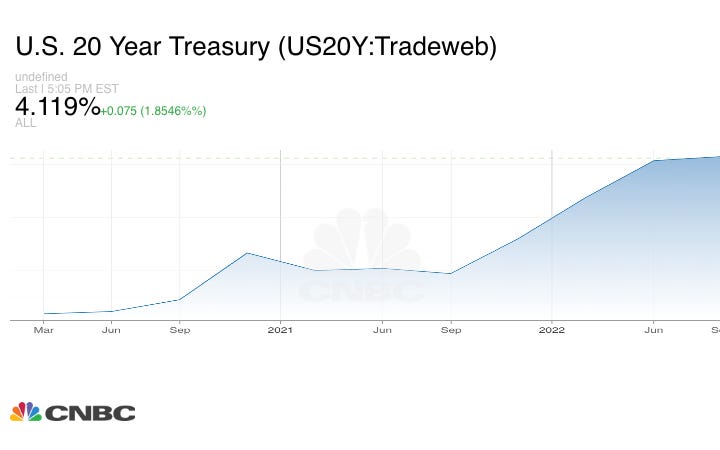

T-Bonds are considered risk-free assets. They are backed by US government and world will most likely collapse if the United States government is not able to service their debt. It is considered safest place for investors to park their money. However, the returns on T-Bonds have recently become attractive (refer to Chart 1) due to Fed aggressively hiking lending rates to curb inflation.

Chart 1: Rising Yields for T-Bonds as of Feb 24th, 2023

Over the weekend my eyes light up when I read that Junk bonds (bonds with low credit quality and having high default rate) are now yielding 8%+. At its current level, is this a better investment over T-Bonds? I want to answer this using data.

Should we pounce on the higher yield?

Junk Bond ETF (HYG) currently yields 8.3%. HYG is heavily concentrated of BB rated companies(60%) and B rated companies (38%). For a sense of scale, more than half of the market now consists of BB rated issues and have highest junk rating. The default rate currently for junk bonds was 1.4% in 2022. Fitch is expecting this to increase 4% in 2023. Assuming this to be even higher at 5%, and the recovery to be at 40% (traditionally true), the loss due to default would be 3%. The adjusted yield would be 5.3% (8.3% - 3%) and making the premium over T-Bonds to be 80bps.

The market appears to be in good shape and unless a hard landing, the default rate should stabilize around 4%. However, the spread of just 80bps not enticing for me given the high risk. If the default rate goes upto 6.5% or beyond, I am losing capital instead of getting any returns. For now, I will stick to the 1 year T-bonds that are yielding 5.11% for 12 months.

I will redo the analysis if the spread between them goes over 5%. It will be interesting to see the adjusted yield and better data around actual defaults. Generally junk bonds are nearly always a better investment than Treasuries, and will be again soon.

To know more about the calculations, or get access to my models, please contact me at karanbathla07@gmail.com or on my LinkedIn.