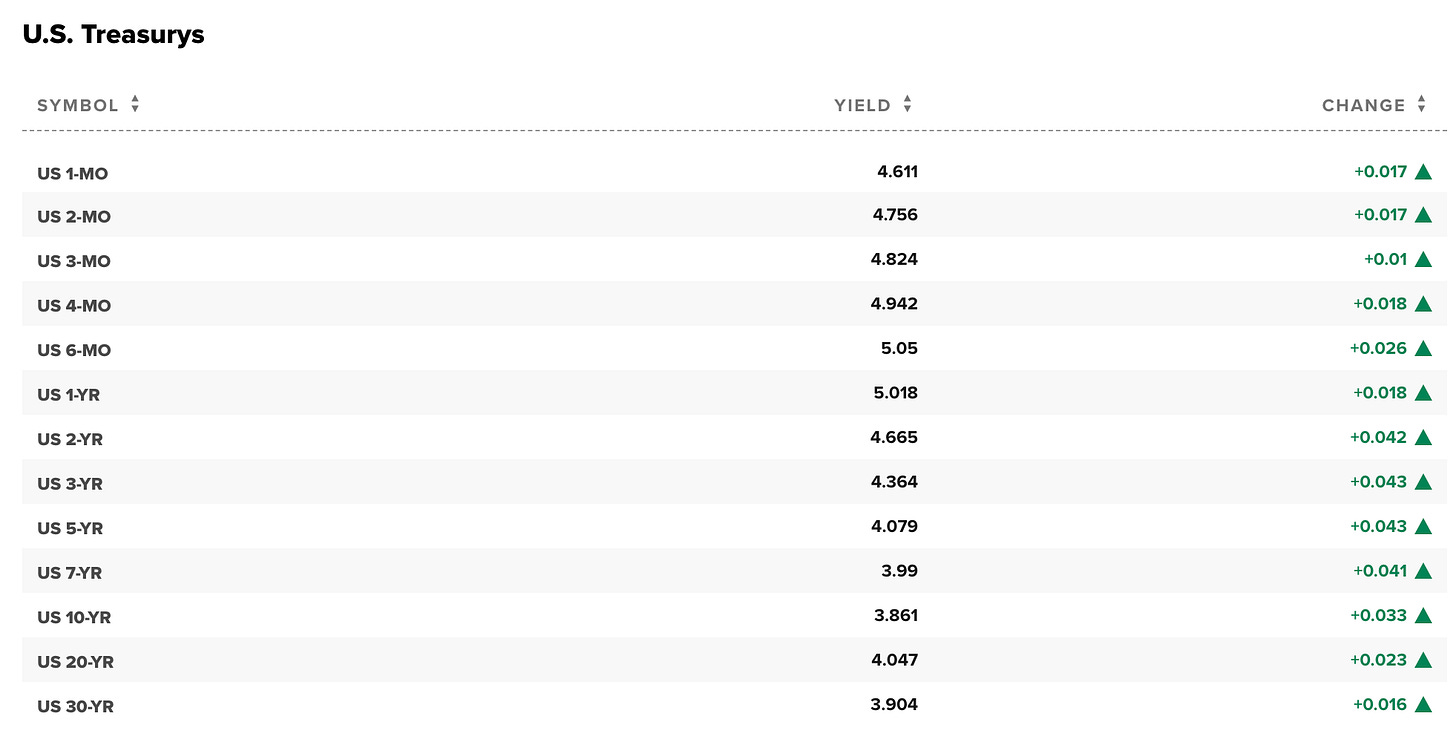

Short Term Treasury Bonds are currently yielding 5%+. The last time the Treasury Bonds were yielding this high was in 2008. I am buying more and more treasury bonds every month to maximize my returns as Fed will eventually start cutting rates. This will lead to higher Bond prices. FYI, yields are inversely promotional to prices unless held till maturity. Getting 5% when the stock market is acting wacky is too hard to pass.

Discussion about this post

No posts